BIOGRAPHY:

Bernard Arnault was born in 1949 in France. His success story is not about climbing to the top of the business from the very bottom. Arnault comes from a wealthy family of hereditary entrepreneurs. In 1926, his grandfather founded the construction company Ferret-Savinel, and in 1950, management of the family business passed to his father Arnault. As a child, the future billionaire studied music, but, according to him, his lack of talent prevented him from becoming a professional.

Bernard Arnault comes from the French city of Roubaix, which is located in the north of the country. His father Jean Leon Arnault owned the construction company Ferret-Savinel, founded by his father-in-law, Bernard’s maternal grandfather. The boy’s mother, Marie Joseph Savinel, was a quite successful pianist, who subsequently instilled in her son a love of classical music and taught him to play the instrument.

Bernard studied engineering at one of the most prestigious schools in France, the Ecole Polytechnique. After graduation, Arnault went to work for his father’s construction company Ferret-Savinel, and in 1971 he took control of the company.

In 1976, Bernard managed to convince his father to liquidate the company’s construction division and invest the proceeds in a more profitable business. According to some reports, the liquidation of the construction division brought the businessman’s family 40 million French francs. By 1979, Bernard changed the name of the family company to Férinel Inc. and focused his attention on acquiring real estate.

In 1981, the socialists came to power in France. The political situation forced the Arnault family to move to the United States. Being a shrewd businessman, Bernard succeeded in his new place. He developed condominiums in Palm Beach, Florida, and then opened a branch of the family real estate business there. In the USA, the French businessman met Donald Trump, who was also building a real estate business.

It is noteworthy that it was in the States that a key event took place, which subsequently prompted Bernard to purchase the Dior fashion house. The businessman was prompted to a future deal by a conversation with a taxi driver. Bernard was impressed that the driver had not heard anything about France, could not name the name of the ex-president (Charles de Gaulle), but knew the Dior brand very well.

In 1983, when the French socialists switched to a more conservative economic course, Bernard and his family decided to return to France. Moreover, by that time the government was looking for someone to transfer control of the bankrupt textile company Boussac, which included the Dior fashion house.

With $15 million in net worth, Arnault reportedly turned to Antoine Bernheim, managing partner of the French bank Lazard Frères and Co., for help. Together they raised another $80 million for the deal. According to other sources, Arnault spent only a symbolic one franc at the auction.

In addition to the Christian Dior fashion house, Bernard Arnault also acquired the Bon Marche department store as part of the deal. The businessman bought the company and renamed the company Financiere Agache and initiated a reorganization, cutting costs and selling part of the business.

Initially, the businessman promised to revive production and save jobs, but instead fired 9,000 workers and pocketed about $500 million by selling most of the business.

In 1987, Bernard Arnault was invited as an investor and chairman of the board of LVMH, owned by Henri Racamier. And in 1990, the French billionaire created a controlling stake in the group, which itself was the product of a merger between the fashion house Louis Vuitton and the champagne and cognac manufacturer Moët Hennessy, and then ousted Louis Vuitton president Henri Racamier from his business.

With others, Arnault deployed the same strategy: investing in enterprises and displacing their founders. Soon LVMH included Christian Lacroix, Givenchy, Kenzo; leather goods companies Loewe, Céline, cosmetics store Sephora and many other brands.

In 1999, Arnault became interested in the Italian leather goods company Gucci, which was then run by Tom Ford and Domenico De Sole. The businessman acted carefully and discreetly. At first he accumulated 5% of shares, and then increased them to 34.4%.

The Italians were against the takeover of their company, so long legal proceedings began that lasted until 2001. The New York Post called the confrontation a “bloody fashion war” and a “shark war.” As a result, LVMH had to retreat. The corporation sold its shares and exited the race with a profit of $700 million.

Arnault continued to acquire luxury brands, including the Italian company Fendi (2003), the iconic French department store La Samaritaine (2010), the Italian jewelry brand Bulgari (2011) and the oldest American jewelry company Tiffany & Co. (2021).

He also built the Fondation Louis Vuitton (2014), a museum of modern art that exhibits famous works of art from the 20th and 21st centuries, some of which are from the businessman’s personal collection. In 2007, Arnault was awarded the title of Chevalier of the Legion of Honor, one of France’s highest awards.

Bernard Arnault net worth:

On April 5, 2023, Bernard Arnault overtook Elon Musk to become the richest person on earth according to Forbes. The publication estimated the businessman’s fortune at $211 billion. The founder of Tesla took second place with a fortune of $180 billion.

Bernard Arnault not only earns well, but also spends a lot. According to some reports, the billionaire owns a private island of 135 acres (54.5 hectares) in the Bahamas. The head of LVMH has a house in Paris, the cost of which has not been disclosed. He also spent about $96 million on residential real estate in several elite areas of Los Angeles.

Bernard Arnault’s family:

Arno was married twice.In 1973, he married Anna Devavrin. The couple had two children, after which they divorced in 1990. A year later, in 1991, the French billionaire married Hélène Mercier, a Canadian pianist. Rumor has it that during the candy-bouquet period, Arno played Chopin and other classical composers for his beloved.

Now the French billionaire and his wife live on the left bank of Paris, south of the Seine River, in the historical quarter. Arno has three children from his second wife. All five of the businessman’s heirs work for LVMH; in July 2022, he proposed to reorganize his holding company Agache to give them equal shares.

The French billionaire’s family is one of the richest clans in the world. Not only Bernard has a high income, but also his children.

His eldest daughter, Delphine, is on the board of directors of LVMH and serves as head of Christian Dior Couture. Her personal net worth is unknown, but in 2022 it was estimated to be approximately $120 million.

The billionaire’s eldest son Antoine (and also the husband of Russian model Natalia Vodianova) holds the position of CEO of LVMH, Christian Dior SE and the shoe company Berluti. According to some reports, his net worth is $500 million.

Alexandre Arnault is the executive vice president of Tiffany & Co. His fortune is also estimated at $500 million.

Frédéric Arnault is the CEO of Tag Heuer. His net worth is estimated to be $155 million.

Bernard’s youngest son, Jean, heads the watch division of Louis Vuitton. It is difficult to answer how much the young man earns, but in 2022 his capital was estimated at $10 million.

Collecting:

In his home, Arnault keeps a collection of works by modernist artists, including Jean-Michel Basquiat, Damien Hirst, Maurizio Cattelan, Andy Warhol and Pablo Picasso.

As the billionaire recalled, his first purchase at auction was Claude Monet’s work “Charing Cross Bridge.”

“I was the only one who bid on this painting, and I got it for a relatively small amount,” said Bernard Arnault.

The billionaire buys paintings not only for himself, but also for his museum of modern art. Arnault admits that for his personal collection he takes those works that he likes and that are “durable.” But purchases for the museum are coordinated with the curator of the institution and art historian Suzanne Page.

Charity:

Bernard Arnault spends large sums not only on personal desires. An impressive portion of his earnings goes to charity. The LVMH Foundation he created often donates money to arts and culture, namely to the reconstruction of historical sites. In 2019, when a fire broke out at Notre Dame Cathedral in Paris, Bernard Arnault pledged $200 million to rebuild it.

LVMH also helps other worthy causes. The organization donated more than $11 million to fight the Amazon forest fire, and at the beginning of the coronavirus pandemic donated more than $2 million to the Chinese Red Cross to help fight the infection.

Scandals related to Bernard Arnault:

Espionage:

In 2021, a court forced LVMH to pay a fine of €10 million ($11.27 million) to settle espionage charges.

As it turned out, Bernard Arnault hired the former head of French domestic intelligence to spy on individuals. In particular, behind the journalist and left-wing activist Francois Ruffin, who made the film “Thank You, Boss” about the billionaire. The film portrays Arnault as a heartless tycoon ruining the French working class.

Consumer fraud:

In 2017, The Guardian released a sensational article in which it revealed some surprising details about the production of Louis Vuitton shoes. As it turns out, fashionable Italian boots and shoes costing more than $600 are not produced in Italy at all, but in Romanian Transylvania, a region more famous for its tales about vampires than for its shoe craft.

The factories are carefully guarded, and the identities of the company’s employees are kept secret. In 2014, a French television crew stopped at the gate. Workers anonymously said that all the brand’s shoes are made in Romania and then sent to Italy, where they add the coveted Made in Italy inscription on the sole.

Influence on the media and interference in Wikipedia:

The French company Avisa Partners, which provides support to large businessmen, top managers, politicians and other important people, found itself at the epicenter of a scandal. In 2022, journalists discovered that the company was distributing fake information and “ghost articles” through its blogs, and also making changes to Wikipedia to improve the ratings of its clients and denigrate its competitors.

And one of the company’s clients was Bernard Arnault. On his page on the French Wikipedia there is a banner that informs readers that the article was changed by one or more contributors who received payment for the edits.

Interesting fact about Bernard Arnault:

Bernard Arnault is a passionate tennis fan. This sport helps him stay in good physical shape. The billionaire often attends important tournament matches, and his idol is Swiss tennis player Roger Federer. By the way, Bernard had the honor of playing with Roger, but lost the set with a score of 6:0.

Why are LVMH shares growing even during a crisis?

The LVMH Moet Hennessy Louis Vuitton empire is holding up better than the tech corporations whose owners dominate Bloomberg’s ranking of the world’s 500 richest people. Arnault’s net worth has increased by $39 billion this year as demand for high-quality products remains strong.

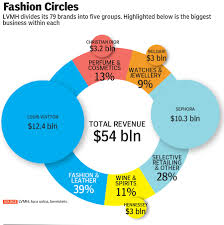

According to Bloomberg, LVMH’s share price reached a record high thanks to last month’s announcement of a 1.5 billion euro ($1.6 billion) share buyback. Last year, the company reported record sales of 79.2 billion euros, while revenue from its cash cow Louis Vuitton topped 20 billion euros.

Anna Buylakova, an analyst at Finam Financial Group, notes that in 2022, LVMH’s revenue increased by 23% per year, net profit by 17% compared to 2021. In her opinion, the results were positively affected by the recovery of international tourism amid the easing of Covid restrictions.

In addition, as the expert emphasizes, LVMH’s target audience includes financially protected segments of the population with a high level of income or savings, whose consumption level is less dependent on economic cycles than that of less affluent households. That is, despite the deterioration in the general state of the economy, the company managed to significantly increase sales, indicating that a certain segment of buyers feels quite confident.

“It is worth noting that the demand for luxury goods can increase as their prices rise, which distinguishes them from ordinary goods, that is, the less affordable a luxury product becomes, the more its value increases. In particular, this applies to status goods, for example, expensive watches. This behavior of consumers significantly simplifies the transfer of cost inflation to the final buyer, protecting the manufacturer’s margin,” concludes Buylakova.