Biography:

Born into the family of a jazz musician and a housewife in New York, Queens.

I was a bad student at school. He coped poorly with memorization and, in his own words, did not like to study.

He worked part-time as a club carrier at a golf club that was frequented by successful investors. The first shares in my life were shares of Northeastern Airlines, purchased for $300. Soon after, the company announced the merger and its shares tripled in value. At that time, Dalio was 12 years old. By the time he entered college, Dalio already had an investment portfolio worth several thousand dollars.

Business:

After university, in 1973 he worked at the New York Stock Exchange, then at several investment companies.

In 1975 he founded his own company, Bridgewater Association. The first office was Dalio’s apartment. In 1985, Dalio received control of part of the capital of the World Bank employee pension fund, and in 1989, the Kodak employee pension fund. Pension funds – public and corporate – make up about two-thirds of the Bridgewater Association’s capital, while the capital of the wealthiest families makes up only a small part of the capital.

Bridgewater Association investors receive daily mailings, monthly performance updates, quarterly reviews and conference calls with Dalio or other Bridgewater executives.

In 2007, Dalio first warned the US Treasury Department and then White House officials about an approaching crisis in the banking sector. “If the economy collapses, it will be an unusual recession,” he warned investors in a January 2008 newsletter. And he turned out to be right.

The Bridgewater Association currently manages $160 billion in assets.

Ray Dalio – the success story and principles that helped turn $300 into billions.

The creator of the world’s largest hedge fund with an unsurpassed talent for predicting economic trends, which happened with the financial crisis of 2008.

Thanks to his innovative approach and his own successful investment schemes, Ray Dalio is often called the Steve Jobs of financial markets. As of 2020, Ray Dalio’s fortune is estimated at $18 billion, and his name has been on Forbes lists for decades. Honesty and discipline allowed the legendary investor to earn billions, and the hedge fund he created, Bridgewater Associates, is valued at over $160 billion, making it the largest in the world. Since 2011, Dalio’s capital has not decreased, and the entire history of his work confirms the thesis that nothing is impossible in the world of investment.

Way to success:

Raymond Dalio, better known to us as Ray Dalio, was born on August 8, 1949 in New York, in the family of musician Marino Dalio, who emigrated from Italy to the States during the years of crisis, and housewife Anne, an American by birth, who was raising her son.

First investments:

Ray first encountered the world of business while working part-time at a golf club, where he often heard club members talking about investing in securities. Quickly realizing that this activity could bring good income, Dalio began actively accumulating start-up capital. He mowed lawns, carried newspapers, shoveled snow and worked part-time at a golf club in order to invest his first earned amount of $300.

For the first investment, shares of Northeast Airlines were selected that met the criteria formed by Dalio himself: a cost of no more than $5 and brand recognition.

“The shares I bought were chosen because I had heard about the company and knew that the price was less than $5. This way, it seemed to me, I could make a big profit.”

The guess turned out to be correct, and after the company was taken over, its assets tripled in value. By the time I graduated from school, I already had several successful and unsuccessful deals under my belt, and my capital had already turned into several thousand dollars.

Hired work:

The first investment successes did not prevent the young investor from enrolling in Harvard and receiving a Master’s degree in business administration after a bachelor’s degree at Long Island University. He successfully combined his training with trading in commodity futures. In 1972, Dalio was hired as an assistant at Merrill Lynch and quickly rose to the level of director of futures.

After the collapse of the company, he worked as director of commodity investments at Dominick & Dominick LLC, but was fired after a fight with his boss and a scandalous speech at a convention of farmers, where Ray specially hired a naked girl to perform. This was followed by another year as a broker at Shearson Hayden Stone, after which he lost his job.

Creation of an investment fund:

Despite the financial crisis and lack of paid work, by the age of 26, R. Dalio had formed the optimal set for making a brilliant career as an investor, with the creation of his own investment company. The Bridgewater Associates fund was founded in 1975 by a young ambitious investor who was determined to conquer the entire financial market. And, as time has shown, he succeeded.

The company’s first steps were related to the provision of consulting services and capital management for several clients “inherited” from a former employer. Gradually, his reputation and customer reviews helped form a client portfolio, which began to attract large clients such as McDonald’s.

By 1981, Dalio moved to Connecticut and moved his foundation’s office there. The next stage of investor activity is related to pension funds. In 1985, a contract was signed with a division of the World Bank. Another 4 years later, Kodak appears among the clients.

Own strategies and models:

The successful development of the company contributed to the growth of the investment portfolio. As a result, the company is implementing the Global marco system. The new strategy is based on painstaking analytical work with several parameters and a selection of investment products around the world. The model developed by Dalio made it possible to prevent the negative influence of external factors on the investment process.

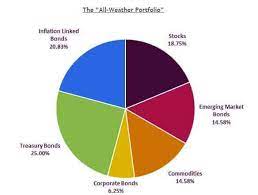

The ideal model is based on the following capital distribution:

government bonds – 55% (of which ¾ are long-term liabilities);

assets of companies from the S&P 500 – 30%;

raw materials, metals, other investments – 15%. With such a portfolio structure, the investor will be able to quickly respond to market changes, quickly transferring capital from one asset to another.

In 1991, a new fund emerged called Pure Alpha, which is based on betting on market returns above average. It was Ray who was the first to apply a new strategy to client portfolios, allowing them to earn about 18% annually through a hedge fund, reliably protecting capital from market fluctuations.

2008 crisis:

Bridgewater’s work is closely related to the analysis of indicators and the study of market fluctuations. Fund experts began talking about the fall of the US economy back in 2006; based on the revealed excess of the cost of debt servicing over income, the company announced an impending failure in the real estate sector.

Unfortunately, the warnings of the billionaire and his team were not heeded by banks and investors. And in 2008, many companies faced serious problems, except for those whose capital was managed by the fund. In 2008, instead of losses, Pure Alpha provided a return of 9.5%.

During the next market shakeout in 2011, other hedge funds on average lost about 4%, while Bridgewater gained 23% for its clients. In subsequent years, the company’s income became a record for its entire existence, allowing Ray Dalio to gain a foothold on the Forbes podium and placing Bridgewater among the industry leaders. The fund’s profit in 2017 amounted to 49.7 billion, which was the best global result.

The main rules of investing Ray Dalio:

Having managed to build his own empire, starting with a $300 investment, the billionaire shares his experience and knowledge with everyone in the famous book “Principles. Life and work.”

These are Dalio’s core principles that helped him earn $18 billion through smart investing and impeccable discipline.

1. Learn to set goals:

The best advice I can give you is to ask yourself what you want, then ask yourself what truth is, and then ask yourself, “What should you do about it?” I believe if you do this, you will move much faster towards what you want in life than if you don’t!

2. Don’t rely on experts:

I remained alert, avoided overconfidence, and learned how to effectively deal with my “not knowing.” I dealt with flaws in my knowledge, either by continuing to collect information until I reached a state of certainty, or by eliminating possible risks due to the lack of completeness of my knowledge. Sometimes, when I realize that I don’t know which way the coin will fall, I try to take a position in order to avoid negative influence on me in any case. In other words, I don’t make random bets. I try to limit my bets to a limited number of things that I am confident about.

3. Have your own opinion:

The general consensus is often wrong, so I have to be an independent thinker. You have to be right when everyone else is wrong to make money. For example, when I wanted to make money in the markets, I knew I needed to learn more about companies to evaluate the attractiveness of their stocks. At that time, Fortune magazine had a little tear-out coupon that you could send in to get free annual reports on any company on the Fortune 500. I ordered all the annual reports and, as I worked through them, I picked the companies that interested me the most. I learn by immersing myself in a new topic, which at first raises many questions, answering which step by step eventually reaches the necessary understanding.

4. Question and verify:

It’s not easy for me to be sure that my opinions are correct. You can do a huge amount of work in the markets and still be wrong. I stress tested my opinions by having them challenged by the smartest people I could find to find out where I was wrong. I’ve never been particularly interested in other people’s conclusions. I was interested in the logic of their reasoning. This way I increased my chances of being right and learned a lot from a lot of great people. These included my stockbroker, the people I carried clubs for, and even my local barber who was also caught up in the stock market.

5. Don’t be overconfident. “Principles.” Life and work.”

The story of Ray Dalio is not a trivial success story. After all, there were moments when the billionaire lost all his capital, and the company’s staff was reduced to one person – Ray himself. Using the example of this man, who surpassed George Soros in wealth in 2011, one can see how desire and aspiration help achieve the impossible. Study the market, analyze the actions of other investors, learn to think and act independently, relying on personal experience and other people’s success stories. This will help you make the path to investment Olympus less difficult and thorny. And our stock analysis service will help you with this.

6. Think about the consequences of your decisions:

I wrestled with my realities, reflected on the consequences of my decisions, all of which allowed me to learn and move forward. Working in this way, I learned how important it is to think for myself and how liberating it is. In short, this is the entire approach that I believe will work best for you – and it is exactly what I want people who work with me to do to achieve outstanding results. I want you to work for yourself, formulate independent opinions, test them under stressful conditions, be careful and avoid overconfidence, think about the consequences of your decisions and constantly improve.

7. Meditate to think clearly:

At that time, the Beatles traveled to India to learn how to meditate. I too have learned meditation to help me think more clearly and creatively, so I am confident that this has increased my enjoyment and success in learning. By the way, I still meditate and still find it helpful.

8. Appreciate your own mistakes, explore your weaknesses:

Since founding Bridgewater, I’ve gained a lot of experience largely through making mistakes and learning from them. The most important thing from this is the following. I learned that failure is mainly a result of not accepting the realities of life and unsuccessfully struggling with them. I realized that achieving success is simply a matter of accepting and successfully interacting with all my realities. I learned that it is necessary to work on mistakes and personal weaknesses in order to overcome them.

9. Adequately balance strengths and weaknesses:

The most important quality that separates successful people from unsuccessful ones is our ability to learn and adapt to our strengths and weaknesses.

10. Correct understanding of reality is the key to success:

“Success comes from people who deeply understand reality and know how to use it to get what they want. The reverse is also true: idealists, out of touch with reality, create problems, not progress… A more accurate understanding of reality is the most important basis for obtaining good results. I spend most of my time learning how the things that affect me the most work, the people who influence the markets and the people I work with.

Everything described in Ray Dalio’s book is equally valuable both at the start of investing and for experienced market participants. In the book you will find precise and specific advice that is quite applicable to all areas of life.